We'll start our Multichannel Forensics series with a quick refresher course.

There are three loyalty modes for every product, brand or channel.

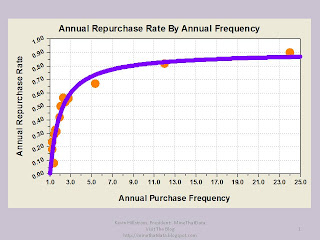

- Retention Mode: When at least 60% of prior year customers purchase again this year (if your business doesn't support a twelve month repurchase period, use a timeframe that is appropriate.

- Hybrid Mode: When between 40% and 60% of prior year customers purchase again this year.

- Acquisition Mode: When fewer than 40% of prior year customers purchase again this year.

We need to classify each product, brand or channel into one of these three modes, so that we can understand the primary way that growth will happen. So many brands are in "Acquisition Mode" and don't realize it, depending heavily on customer acquisition for long-term health.There are also four Migration Modes that each product, brand or channel fall into.- Isolation Mode: This happens when the customers in a product, brand or channel do not migrate to other products, brands or channels. For instance, customers who purchase Mens apparel are unlikely to buy Womens apparel. Mens apparel buyers are in "Isolation Mode".

- Equilibrium Mode: This happens when the customers in a product, brand or channel are willing to try other products, brands or channels. For instance, customers who purchase Womens apparel might purchase Mens apparel for their spouse. Womens apparel buyers are frequently in "Equilibrium Mode". This mode is common, and is responsible for all of the interesting dynamics that occur when customers shift from one product line (DVD Players) to another (Blu-Ray DVD Player).

- Transfer Mode: This happens when the customers in a product, brand or channel are actively switching loyalty. Over the next decade, automobile purchasers will actively transfer loyalty from gas-guzzling cars to hybrid cars and other technologies. CEOs need to recognize this mode, and react in a positive way in order to protect jobs.

- Oscillation Mode: Sometimes, customers switch back and forth between products, brands or channels. This is known as "Oscillation Mode". Computer buyers purchase software and peripherals, then switch back to buying a new computer, then switch to software and peripherals, resulting in "Oscillation Mode".

The combination of Loyalty Mode and Migration Mode yield the unique situation a product, brand or channel resides in.Maybe you are a catalog CEO. If your catalog channel is in "Acquisition/Transfer" mode, your job is to scale back on catalog advertising over time, as your customers won't allow you to grow this channel anymore.Maybe you are a Merchandise EVP. If your product is in "Retention/Isolation" mode, you thoroughly control your merchandise line. Your customers are loyal to your products, and do not switch loyalty to another merchandise line. You have the potential to be a rock star.Maybe you are the General Manager of the Online Channel of a Multichannel Brand. If your channel is in "Hybrid/Equilibrium" mode, you have a very interesting channel to manage. Your customers want to shop your store channel, but aren't avid store customers. Strategically, you can influence your customers by the marketing techniques you use. Do you want your customers to shop online, in stores, or anywhere? In many ways, you get to decide!This week, we'll look at several case studies, examples that help CEOs understand how to manage multichannel complexity!Labels: Acquisition Mode, Equilibrium Mode, Hybrid Mode, Isolation Mode, Loyalty Mode, Migration Mode, Multichannel Forensics, Oscillation Mode, Retention Mode, Transfer Mode

We frequently read about a metric called "Churn Rate".

We frequently read about a metric called "Churn Rate".