Please click on the image to enlarge it.

Please click on the image to enlarge it.

Spending two days at a multichannel marketing conference helps crystallize one's image of where our industry is heading.

My biggest revelation from 12,000 miles of travel and two days of multichannel discussions is that we have not given business leaders the tools necessary to identify the roles channels/advertising play in what used to be the Catalog industry.

So here are nine ways that catalogs interact with websites. For each classification, think about how different the marketing strategies need to be to yield satisfactory business results. Which of these nine situations is your business classified in?

Dissimilar Customer Audience: When catalog is in isolation, and the online channel is in isolation, you have two completely different customer audiences purchasing from each channel. You have a multichannel business, one that your customers don't use in an integrated manner.

Tries Online, Prefers Catalog: Infrequently, catalog is in isolation while the online channel is in equilibrium. This used to happen in the late 1990s, when catalog customers tried to purchase online, only to find the purchase experience preferable via the telephone. Today, businesses with a target customer between the ages of 65-85 might be in this situation.

Online Channel Is Not Appealing: When customers shop online, then transfer their sales back to catalog (catalog = isolation, online = transfer), you know that the customer does not find the online experience appealing. This usually represents a good time for a site redesign.

Classic Channel Shift: The most common catalog scenario occurs when catalog is in equilibrium and online is in isolation. This means the catalog is driving sales online, and when the catalog succeeds at doing this, the customer tends to stop using the telephone to place future orders. Long-term, this spells trouble for the catalog as a purchase channel, and is a harbinger of significant change for the catalog as an advertising vehicle.

Outside of the catalog industry, think about other business models that are going through this transition (old channel = equilibrium, new channel = isolation):

- CDs to MP3s

- Newspapers to Online News

- Gasoline-fueled Cars to Hybrid/Electric Cars.

- CRT Computer Screens to LCD Computer Screens.

- Desktop Computers to Laptop Computers.

Classic Multichannel Business: Multichannel pundits suggest that many catalogers exist in this situation (catalog = equilibrium, online = equilibrium). In other words, in this situation, customers freely pick and choose the channel they wish to purchase in. Products and solutions from the vendor community are frequently created to solve the challenges faced by companies in this situation. Unfortunately, few catalogers are in this situation.

Over-Marketing: Catalogers that offer a myriad of promotions to get customers to purchase online occasionally find themselves in this situation (catalog = equilibrium, online = transfer). The customer shops online only when prices are cheap or promotions make the online channel temporarily irresistible!

Catalog = Brand Advertising: When catalog is in transfer mode, and the online channel is in isolation mode, the catalog marketer is gearing up for a big change. Telephone shoppers are leaving in a mass exodus for the online channel. Once online, the customer won't shop via telephone again. Long-term, the catalog strategy is likely to change for a company in this situation. The catalog will likely evolve into a potentially useful brand advertising vehicle that communicates the broad assortment of merchandise available online.

Catalog = Sales Driver: When catalog is in transfer mode, and the online channel is in equilibrium mode, it is likely that the catalog is a very effective selling vehicle. The customer does not perceive differences between the channels, willing shopping via telephone or website. Better yet, the catalog is causing online orders. Long-term, this business model has a good chance of having a viable catalog advertising vehicle.

Ideal Multichannel Business: I have yet to see a catalog business operate in this mode (catalog = transfer, online = transfer, yielding true oscillation between channels). This would truly represent multichannel nirvana!

Labels: catalog, e-commerce, Equilibrium Mode, Isolation Mode, Multichannel Business Models, online, Transfer Mode

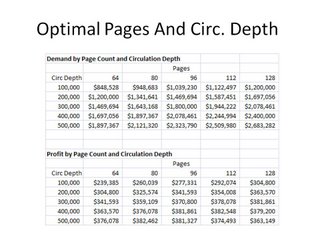

Old school catalogers spend considerable time optimizing circulation depth and pages per catalog (please click on the image for more information).

Old school catalogers spend considerable time optimizing circulation depth and pages per catalog (please click on the image for more information).