Metrics That Matter

How many of you know how many of last year's customers will purchase again this year?

All the business intelligence pap about dashboard reports sells software. A few key metrics, metrics that I used to see printed out on green/white tractor paper back in 1991, will give you insight into where your business is heading. Let's review a few simple tables that many direct marketers produce.

This table analyzes existing customers. These were prior customers, acquired more than a year ago. For the 2008 row, these customers were acquired in 2006 or earlier, and placed at least one order during 2006.

| Last Year Existing Buyer Performance | |||||

| Households | Rebuy Rate | Spend/Rebuy | Volume/HH | Tot. Demand | |

| 2008 | 124,384 | 53.7% | $274 | $147.14 | $18,301,613 |

| 2007 | 135,048 | 56.1% | $283 | $158.76 | $21,440,626 |

| 2006 | 117,349 | 52.4% | $249 | $130.48 | $15,311,228 |

| 2005 | 110,841 | 51.9% | $208 | $107.95 | $11,965,508 |

| 2004 | 119,439 | 50.9% | $203 | $103.33 | $12,341,274 |

| 2003 | 117,430 | 54.9% | $201 | $110.35 | $12,958,283 |

| 2002 | 102,843 | 55.8% | $200 | $111.60 | $11,477,279 |

This is direct marketing's version of "comp store sales". The marketer reviews the volume per household column, to understand if performance is improving over time. In this case, performance is down significantly in 2008, because the repurchase rate and spend levels are down. Also notice what happened back in 2005 --- metrics improved, but total demand decreased, because of a lack of file momentum coming out of 2004.

Direct marketers produce a table of this style for existing customers. A comparable table is produced for customers who were newly acquired in the prior year. This helps the direct marketer understand if newly acquired customers are holding up their end of the bargain.

Another table sums new and reactivated customers. Any customer who did not purchase in 2007, but purchased previously, and purchased during 2008, is included in the table, as are all new customers. The table looks something like this (each row replicating prior years).

| New/Reactivated Buyer Performance | |||||

| Households | Rebuy Rate | Spend/Rebuy | Volume/HH | Tot. Demand | |

| 2008 | 53,941 | 100.0% | $188 | $188.00 | $10,140,908 |

| 2007 | 47,204 | 100.0% | $215 | $215.00 | $10,148,860 |

| 2006 | 42,048 | 100.0% | $203 | $203.00 | $8,535,744 |

| 2005 | 50,884 | 100.0% | $189 | $189.00 | $9,617,076 |

| 2004 | 48,778 | 100.0% | $185 | $185.00 | $9,023,930 |

| 2003 | 45,224 | 100.0% | $183 | $183.00 | $8,275,992 |

| 2002 | 39,005 | 100.0% | $180 | $180.00 | $7,020,900 |

In this table, we observe that 2008 hasn't been a bad year for new/reactivated buyers. Of course, your analysts will keep close watch on cost per new/reactivated customer, but from a dashboard standpoint, buyers are up, demand is down, yielding about the same amount of demand as last year.

These three tables tell the Executive an awful lot about the health of the brand. You can run the tables by channel or merchandise division if you wish. For many direct marketers, these metrics help diagnose the health of the business.

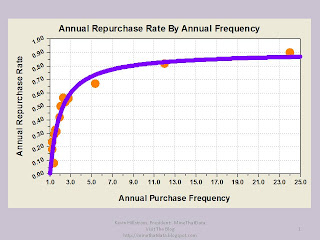

Labels: Repurchase Rate