Catalog Matchbacks: FAQs About Why They Cost You Profit

You had questions about my thesis that catalog matchbacks are costing you profit. Let's answer your questions.

You had questions about my thesis that catalog matchbacks are costing you profit. Let's answer your questions.Question: "What do you have against the vendor community? How can you criticize folks who've helped us through tough economic times, and are always there for us?"

Let me be clear. I am not being critical of members of the vendor community who have your best interests at heart. Plenty of folks in the list industry and the co-ops make the right decisions for you every single day. In fact, I recommend many folks from Millard or ALC or Abacus to you (as examples), when asked.

Always remember, however, that most in the catalog vendor community make more money when you mail more catalogs. There is a disincentive for the vendor community to share best practices in housefile contact strategy testing, because doing so is detrimental to their business, and could result in the vendor employee losing his/her job. I've witnessed this conflict first hand, where the vendor gives you an answer that ultimately benefits the vendor more than you. So do the right thing for your business, ask valid questions of your vendor reps, and closely monitor their response.

Question: How can you mail catalogs and get negative demand, I don't understand?

One of the myths of the "multichannel era" is that everything fits together, is additive or even multiplicative! This simply isn't true, and is clearly illustrated every time you execute a catalog housefile mail/holdout test. Advertising doesn't necessarily cause customers to spend more. Sometimes (often), advertising causes customers to change behavior. Some catalogers find that when you don't mail catalogs, demand from e-mail marketing doubles ... in essence, the lack of a catalog causes the customer to switch loyalty to e-mail marketing. You can't see that outcome unless you execute the test. That is an example of "negative demand". In other cases, mailing the catalog causes customers to spend more on e-mail marketing, this is the classic "multichannel era" outcome of 1+1=3. It does happen. But you cannot know it until you execute mail/holdout tests.

Question: If I execute a mail/holdout test, I'll lose demand, and I can't afford to do that when the economy is so bad. Why are you constantly recommending that I do something that hurts my business?

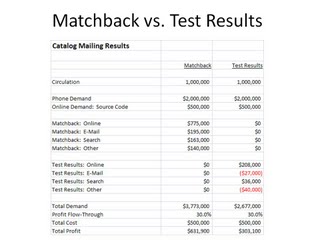

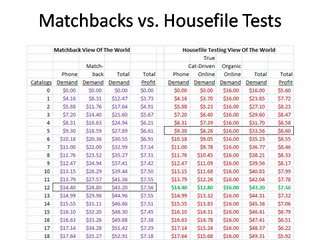

I wouldn't recommend that you do something that hurts your business. I am asking you to execute the test so that you can identify the most profitable catalog mailing strategy. Take a look at the image at the start of this post. On the left-hand side of the table, you see what happens when you follow your matchback results. You'll mail 12 catalogs to this customer segment. On the right-hand side of this table, you see what happens when you test different numbers of catalog mailings to a customer. You see that demand happens whether you mail catalogs or not to a customer. You see that 8 catalogs is the optimal strategy. You see that if you mail 8 catalogs, you increase profit by +/- 20%, per customer. Show me what other strategy you have in your toolkit to immediately increase customer profitability by 20% today?? If you want help executing/analyzing/implementing a contact strategy view of catalog customers, contact me!

Question: Are matchbacks invalid for outside lists?

No, go ahead an use matchbacks for outside lists, that's a good way to evaluate prospects.

Question: We go to great lengths to capture key codes on online orders. Why do we need to execute mail/holdout tests when we ask the customer to enter a key code?

Here's a neat finding from mail/holdout tests ... if you don't mail a catalog, a customer is likely to use an older catalog and will enter an older catalog key code. Or other times, the customer will just visit your website because she loves your brand. Imagine that? She'll simply come to your website unprompted by a catalog mailing, and will place an order, sans key code. That's the best measure of customer loyalty ... a customer willing to shop without advertising. How will you ever be able to accurately measure customer loyalty unless you execute the mail/holdout test?

Question: We know that 80% of our online orders are matched back to a catalog, so we know that matchback analytics are right for our business. Why would you ever recommend abandoning a methodology that is so useful?

There are two issues with your comment. First, when a catalog brand gets 80% of online orders from catalog mailings, the catalog brand is not doing a good job of online marketing. Second, the matchback algorithm is incorrectly allocating orders to catalogs. As stated earlier, your most loyal customers will always shop from you, regardless whether you mail catalogs or not. In other words, you don't need to advertise as often to your best customers ... they already love you!! How can it possibly hurt to execute a mail/holdout test and learn the optimal number of catalogs to mail to a customer?

Question: In your examples, if you don't mail catalogs, catalog demand decreases. We cannot support top-line sales declines. Why would you advocate hurting our business?

I'm advocating a strategy that makes you more profit. Profit dollars matter. My strategy means you end up spending less on catalog marketing, generating a decrease in top-line sales. I recommend re-investing that money in customer acquisition, online marketing/search, mobile, and in some cases social media strategies, in order to grow your business. If done right, top-line sales won't decrease, and you'll be more profitable.

Ok, it's time for your questions. What do you want to learn?

Labels: Matchback