Click on the image to enlarge it.

Click on the image to enlarge it.

There are a series of fundamental truths about direct marketing that, while generally understood, are not actively practiced.

We all know that if you don't market to a customer, generating significant sales and profit become unlikely.

We also know that if you market too much to a customer, customers rebel, or the marketing is highly unprofitable.

The best direct marketers measure marketing effectiveness over time. In other words, the best direct marketers segment customers at the start of the year (calendar or fiscal). Next, customers are placed into different test groups. Some customers receive almost no direct marketing. Some customers receive too much direct marketing. At the end of the year, the direct marketer measures the repurchase rate, spend per repurchaser, average spend, and average profit, based on the contact strategy test the customer participated in.

Click on the attached image. This is what test results typically look like. In this case, customers received anywhere between six and sixty-six catalogs during a twelve month period of time.

At just six catalogs (one every other month), the customer segment had an average response rate of ten percent. The annual repurchase rate was 46.9%. The average customer generated $15.00 of profit.

At twelve catalogs (one per month), the customer segment had an average response rate of 7.1%. This is a very common situation --- by adding catalogs, we artificially cause each catalog to perform slightly worse. However, the annual repurchase rate increases from 46.9% to 58.5%. Better yet, annual profit increases from $15.00 per customer to $17.70 per customer.

Clearly, it is better to mail twelve catalogs than it is to mail six catalogs.

The table shows that profit is "maximized" at eighteen catalogs.

Now take a look at the scenario where twenty-four catalogs are mailed. Response rates continue to deteriorate. Annual repurchase rates continue to increase. Annual profit begins to decrease.

It is at this point that things become very interesting in your average catalog-based business. As you go from twenty-four to thirty catalogs (in this example), profit begins to erode, faster and faster as catalogs are added to the contact strategy.

There is an unusual dynamic that occurs in catalog companies that reach this stage. The CFO quickly points out that the "ad-to-sales" ratio is increasing at an unacceptable rate. The CFO might even want to cut back on catalog mailings.

Your merchants might view things differently. Merchants are charged with increasing sales --- one of the ways to do this is to increase pages, or increase the number of mailings. A merchant might recommend a new catalog title, focusing on a slightly different assortment of merchandise, targeted to a slightly different customer. The merchant might recommend six additional mailings, asking for a two year trial to see if sales can be grown, to see if a new target audience can be harvested.

Often, two or three merchants recommend this strategy. Suddenly, there are thirty-six or forty-two mailings in the catalog plan.

The merchants are under pressure to "grow sales". The way to do this is not to spend a ton of time prospecting for new customers. The way to do this is to mail "best customers".

This strategy artificially lowers catalog response rates, increases annual repurchase rates, and lowers profit per customer.

Eventually, something gives. If the business fails to meet plans by maybe ten or fifteen percent, the CFO gets enough power to enact change.

If the CFO isn't as strong a leader as the merchants are, circulation changes come in the form of cuts in circulation depth --- instead of mailing 1,000,000 customers per mail date, circulation depth drops to 850,000 customers per mail date. This is a short-term fix ... profit is slightly improved. The long-term problem of having too many catalog in the mail plan causes us to invest too much in our "best customers".

If the CFO is a strong leader, an excellent communicator, then real change can happen. Various catalog titles are dropped, various in-home dates are dropped.

Things get interesting when going down this path. Taking this approach cases the annual repurchase rate to decrease. This dynamic causes a reduction in the strength of the "housefile". With fewer active buyers, next year's sales potential is reduced. This will cause various leaders to want to advertise more next year, or the year after, in order to grow the housefile back to a level of perceived strength.

Of course, the way to balance this dilemma is to manage customer acquisition and customer reactivation activities in a manner that fuels total file growth.

But at an executive level, the concepts of customer retention, customer reactivation, and customer acquisition are too "geeky" to pay attention to. It is easier to think about adding catalogs, developing new products, presenting products differently, or to find new "target" audiences.

In almost every company I've visited or worked for, investment in direct marketing is overly focused on "best customers". Catalog mailings, e-mail mailings, loyalty programs, postcards, you name it --- everybody marketer wants to be successful. The best chance for success is with "best customers", right? Or is it?Labels: catalog, optimization, Profit

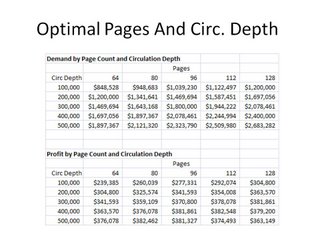

Old school catalogers spend considerable time optimizing circulation depth and pages per catalog (please click on the image for more information).

Old school catalogers spend considerable time optimizing circulation depth and pages per catalog (please click on the image for more information).