Lifetime Value And Organic Buyers

We're being asked to reduce marketing expense in 2009.

We're being asked to reduce marketing expense in 2009.A current best practice is to calculate lifetime value. Customers with sufficient "LTV" receive outbound marketing, while customers with low "LTV" are not targeted with outbound marketing.

This year, the process is changing. We're being asked to not only forecast lifetime value, we're being asked to identify customers who experience lifetime value reductions because of our actions.

This sounds odd, but it really isn't an unusual concept. In the past, we'd identify a 13-24 month customer who loses $10.00 per order, and has $5.00 of LTV. This customer would be suppressed from subsequent campaigns because net LTV is -$5.00.

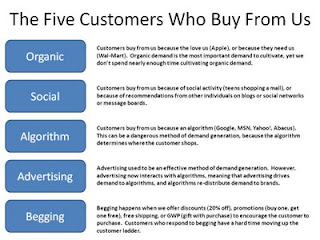

In 2009, we need to identify the customers who are likely to generate "organic demand" in the future. Amazingly, these customers can experience lifetime value reductions if we market to them, because the customer was going to purchase merchandise anyway.

The majority of CEOs working on Multichannel Forensics projects are asking me to identify organic customers. This is becoming an important part of the marketing process.

For the Statistical Modeler, this represents yet another "offshore drilling" opportunity --- a chance to work on something unique and new.

For the Catalog Marketer, this is a chance to reduce expense while not harming the top line.

For the E-Mail Marketer, this is a golden opportunity to reduce contacts to customers likely to order anyway.

And for the optimization whiz, go ahead and set up a bunch of marketing experiments. Testing is the best way to identify customers likely to generate organic demand!!

Labels: Lifetime Value, Organic Demand